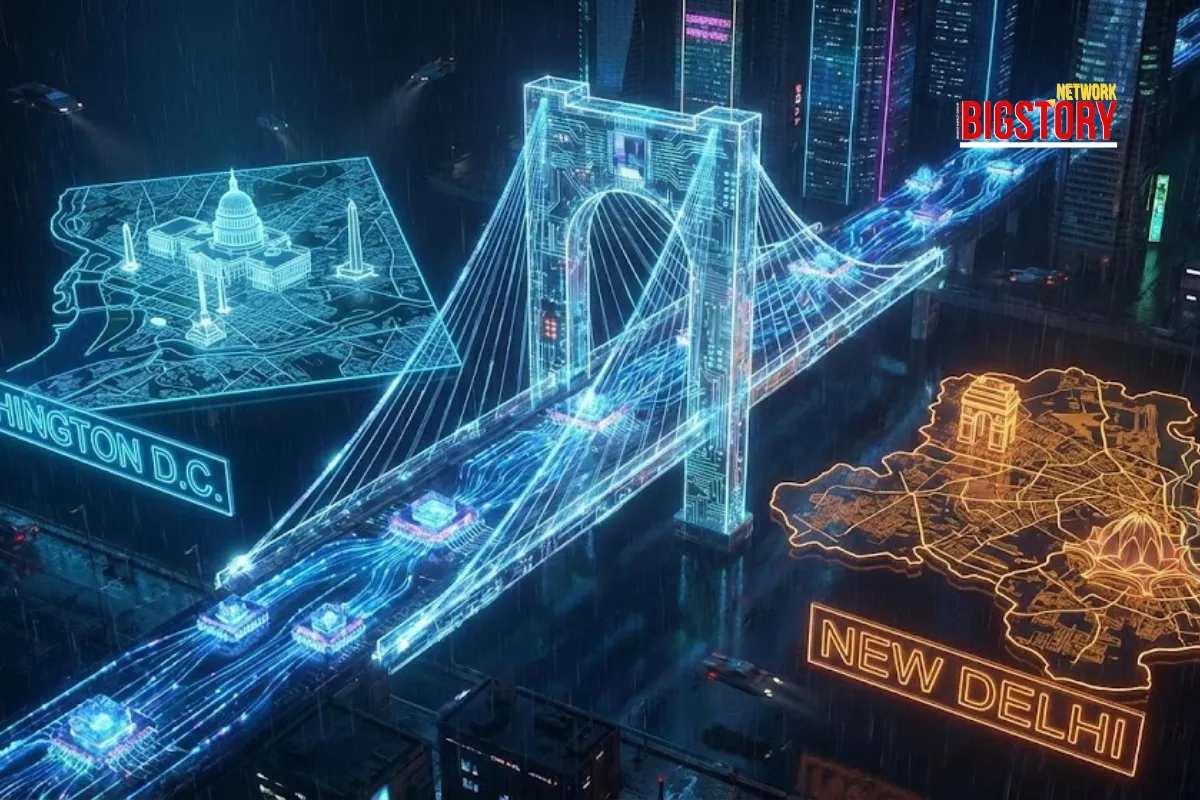

US-India Trade Deal 2026: Trump slashes tariffs to 18% as India agrees to halt Russian oil imports. Analysis of the $500B energy shift and market impact.

Sseema Giill

Sseema Giill

Indian markets witnessed a historic 5% surge today as the Nifty and Sensex hit record highs following a late-night breakthrough in trade negotiations between President Donald Trump and Prime Minister Narendra Modi. The deal immediately slashes the punitive 50% "Reciprocal Tariffs" on Indian exports to just 18%, effectively ending a six-month trade war that had paralyzed Indian manufacturing hubs from Tiruppur to Surat.

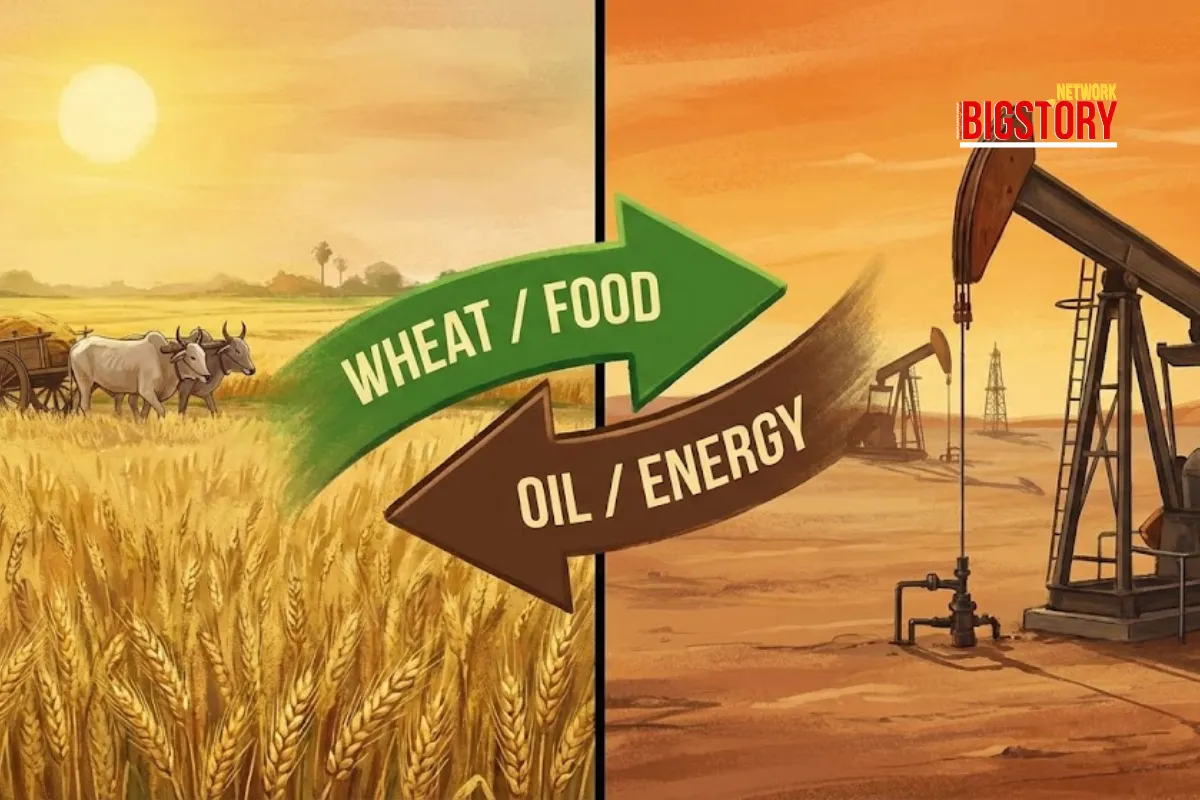

The cost of this market access is a seismic shift in India’s foreign policy: New Delhi has reportedly agreed to a total "wind-down" of Russian oil imports, pivoting its energy security toward $500 billion in future U.S. and Venezuelan crude and LNG procurement. While the market celebrates the relief for textile and IT exporters, the deal marks the most significant realignment of Indian energy logistics in decades.

Donald Trump (US President): The architect of the "Tariff-for-Energy" swap. By forcing a $500B purchase pledge, he aims to neutralize the U.S. trade deficit while physically displacing Russian influence in the Indo-Pacific.

Piyush Goyal (Commerce Minister): The negotiator managing the domestic fallout. He must now balance the "win" for Indian exporters against the technical and inflationary risks of replacing cheap Russian crude with market-rate U.S. energy.

Ajay Srivastava (GTRI Founder): The leading skeptic. He warns that the "Zero Tariff" promise on U.S. agriculture (dairy/soy) remains a "black box" that could devastate 86% of Indian farmers if binding text is released.

While the mainstream media celebrates the "Market Boom," the deeper story is a Sovereignty Swap. By trading the right to buy cheap Russian oil for U.S. market access, India hasn't just won a trade deal—it has accepted an informal "Energy Tax."

U.S. crude is lighter, sweeter, and more expensive to ship than Russian Urals, meaning Indian refineries (optimized for heavy-sour crude) face a massive technical and financial recalibration. Trump has effectively subsidized U.S. energy exporters by leveraging India's manufacturing dependency, forcing New Delhi to trade its non-aligned foreign policy for a seat at the American consumer table.

Has India secured a sustainable path to economic growth, or has it simply traded a reliable energy partner for a volatile trade boss?

What is the new US tariff rate for Indian goods in 2026? The rate has been reduced to 18% from a peak of 50%, effective immediately for most manufacturing sectors.

Did India agree to stop buying Russian oil? Yes, per the agreement, India will wind down Russian crude purchases and pivot to U.S. and Venezuelan suppliers to meet its energy needs.

Will petrol prices increase in India due to the trade deal? Likely. Replacing discounted Russian oil with market-rate U.S. crude may increase input costs for refineries, which could translate to higher prices at the pump.

Which sectors benefit most from the US-India trade pact? Textiles, gems and jewelry, IT services, and pharmaceuticals are the primary beneficiaries of the restored 18% tariff rate.

Does the deal include US dairy and agriculture? While President Trump has claimed a move toward "Zero Tariffs," the Indian government has not yet officially confirmed the removal of duties on sensitive dairy and agriculture sectors.

News Coverage

Context & Analysis

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs