We decode the structural conflict at Navi Mumbai Airport: why Adani demanded ₹92 Lakh/month, the 'Active DAS' technology war, and why BSNL is the only network standing.

Minaketan Mishra

Minaketan Mishra

December 2025. The Navi Mumbai International Airport (NMIAL) inaugurates its first commercial flight. It is a moment of national pride—a "Smart Airport" for a rising superpower. But as the first passengers step into the gleaming terminal, they are greeted by a digital paradox.

The public display boards, typically reserved for flight times, bear a stark, almost dystopic notification: “Mobile signals for Bharti Airtel, Reliance Jio, and Vodafone Idea may not be available.”

In an era where connectivity is considered a basic utility like oxygen, the country's largest infrastructure project has launched with a total communications blackout for private carriers. This is not a glitch. It is not "unfinished construction". It is a calculated siege.

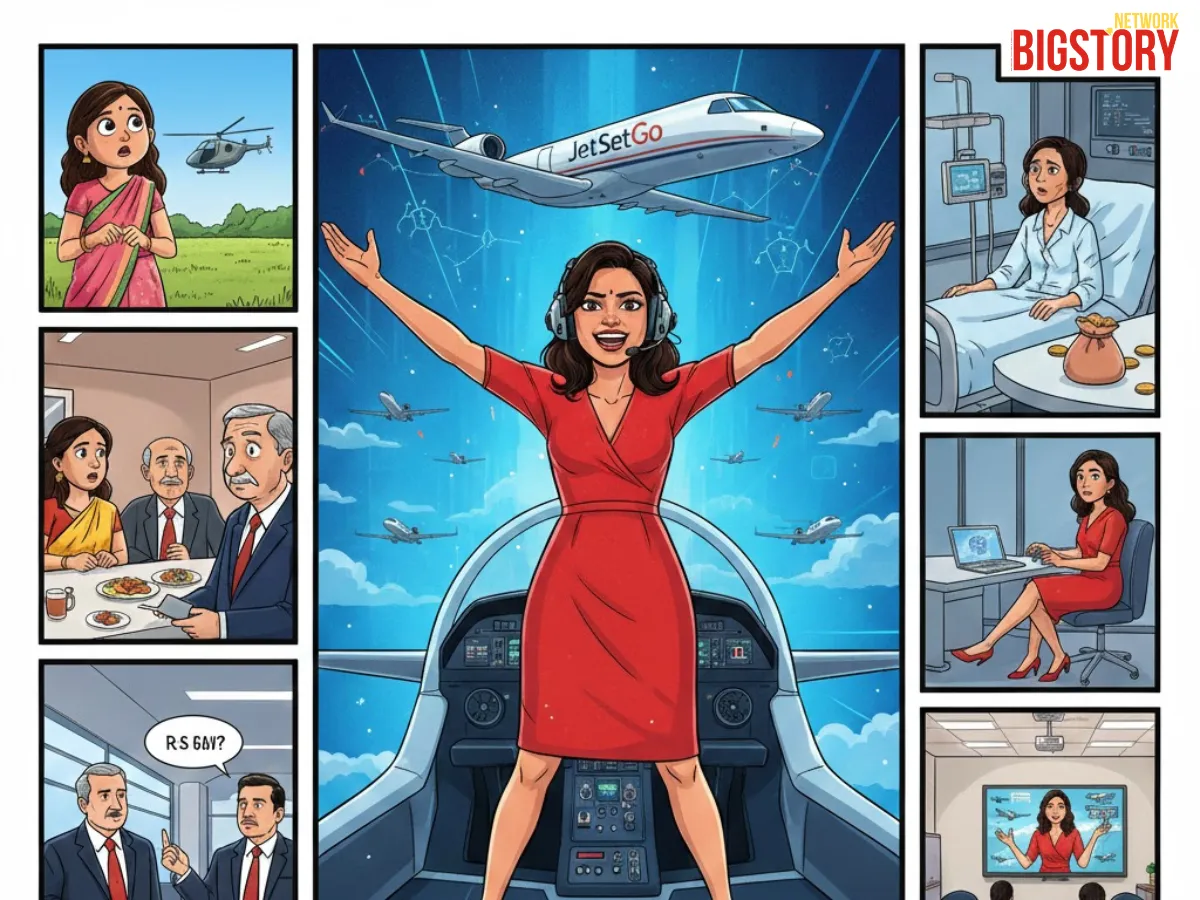

Welcome to the "Invisible War"—a conflict that isn't about planes or passengers, but about the control of the "Last Meter" of India's digital economy.

To understand the silence at the airport, you must look away from the terminal and into the spreadsheets. The root cause is a fundamental clash of business models between the Landlord (Adani) and the Network (Telcos).

For two decades, the telecom equation was simple: Telcos Built, Landlords Rented. Operators like Jio and Airtel would bring their own cables and antennas (Passive Infrastructure), paying the building owner a "Space Rent" for the square footage occupied. The Telco owned the asset, controlled the quality, and paid a nominal fee.

At Navi Mumbai, Adani NMIAL has rewritten the rules.

The airport operator has asserted "sovereign control" over the building's digital veins. They have deployed the network themselves and are demanding that Telcos plug into it as tenants. The cost? As reported by The Hindu, the Cellular Operators Association of India (COAI) alleges a fee of ₹92 Lakh per month, per operator.

Let’s decode that number.

Adani is effectively transforming the "Last Meter" from a CapEx model (where Telcos invest once) to an OpEx model (where Telcos pay rent forever). It is the difference between buying a house and renting a hotel room for the rest of your life. The Telcos view this not as a service fee, but as a "toll tax" levied by a gatekeeper.

The dispute is also technical. If you ask the airport why they are doing this, they will point to the ceiling.

Traditionally, Indian Telcos favor "Passive DAS" (Distributed Antenna Systems). Picture a copper coaxial cable running through the ceiling. It’s "dumb," cheap, and reliable. But copper has a flaw: Attenuation. As the cable gets longer, the signal gets weaker. In a massive terminal like NMIAL, a copper signal dies before it reaches the boarding gate.

Adani’s solution is "Active DAS."

According to industry reports, the airport awarded a contract to domestic manufacturer Frog Cellsat to deploy their "OneDAS" system. Unlike copper, this system converts radio signals into light (optics), shoots them across the terminal via fiber, and reconverts them at the antenna.

Why the "Active" obsession? It comes down to the physics of 5G. The high-speed bands (3.5 GHz and 26 GHz mmWave) that deliver "Gigabit speeds" are fragile. They cannot travel far over copper. Active fiber is the only way to deliver true 5G indoors.

But here lies the "Systemic Flaw" for the Telcos: Vendor Lock-In. If Jio plugs into Frog Cellsat’s equipment, their signal is processed by Adani’s hardware.

The Telcos lose their sovereignty. They are terrified that the innovation timeline will no longer be dictated by their engineering teams, but by the landlord’s procurement department.

In any good corporate thriller, there is a character who breaks the deadlock. In this story, it is BSNL.

While private giants like Jio and Airtel are locked out, the state-owned BSNL is reportedly "in the advanced phase of testing" the airport's infrastructure. Adani NMIAL recently confirmed in a statement to ET Telecom that BSNL is already integrating with their IBS system.

On the surface, this looks ironic—the struggling state operator working while the tech giants are silent. But strategically, this is Adani’s Checkmate move.

Adani is using the government's own player to break the private cartel's defense.

This entire battle is being fought in the blind spots of the new Telecommunications Act, 2023.

The COAI is firing legal missiles, claiming the airport is a "Public Entity." As detailed in disputes covered by BusinessWorld, under the new law, a "Public Entity" (like an airport or metro) must provide access (Right of Way) at nominal administrative costs—pennies on the dollar. They argue that Adani cannot profit from public infrastructure.

But NMIAL has a clever defense. They aren't just a landlord; they hold a Virtual Network Operator (VNO) License. Adani argues: "We aren't renting you space (which is regulated). We are selling you a service (connectivity), and B2B service pricing is unregulated."

It is a brilliant legal distinction. By wearing the hat of a "Telco" instead of a "Landlord," they bypass the rent control laws entirely.

Why fight this hard for ₹44 Crore a year? For a group the size of Adani, that is rounding error. The answer lies in the Data, and in the future.

When the mobile signal fails, passengers are forced to use the "Free Airport Wi-Fi," accessed via the Adani One App. Suddenly, the user relationship shifts. The Telco becomes a "dumb pipe" outside the airport walls. Inside, Adani captures the data—your location, your dwell time, your shopping habits.

This is a prototype. The "Neutral Host" model being tested at Navi Mumbai is likely the blueprint for the Dharavi Redevelopment Project—a city within a city. If Adani establishes the right to control the "Last Meter" here, they can replicate it in every residential tower, mall, and smart city they build.

The silence at Navi Mumbai is not an accident; it is a negotiation tactic.

The "Invisible War" forces us to ask a difficult question: Is digital connectivity a public utility that must be accessible to all, or is it a premium amenity that landlords can monetize?

For now, the passengers are collateral damage. But make no mistake—the outcome of this dispute will decide whether your future 5G connection belongs to the network you pay, or the building you stand in.

Q: Why is there no mobile signal at the new Navi Mumbai International Airport (NMIAL)? A: The signal blackout is due to a commercial dispute. The airport operator (Adani) has restricted Telecom Service Providers (Jio, Airtel, Vi) from installing their own antennas. Adani wants them to use the airport’s own "Active DAS" system, but the Telcos have refused to pay the high fees demanded for access.

Q: What is the ₹92 Lakh dispute between Adani and the Telcos? A: According to the COAI, Adani NMIAL is demanding a monthly fee of approximately ₹92 Lakh per operator to use the airport's in-building network. The Telcos argue this is exorbitant and vastly higher than the standard "Space Rent" model, effectively turning the airport into a toll gate for connectivity.

Q: What is the difference between Active DAS and Passive DAS? A: Passive DAS (favored by Telcos) uses simple copper cables to distribute signals; it is cheap and reliable but struggles with distance. Active DAS (used by Adani) uses fiber optics and electronics to boost signals, which is essential for high-speed 5G in large buildings but is expensive and creates "vendor lock-in" risks for the operators.

Q: Is BSNL working at Navi Mumbai Airport? A: Yes. Reports indicate that state-owned BSNL is in the advanced stages of testing on the airport's network. Strategic analysts believe Adani is using BSNL to prove the technical viability of their system and isolate the private carriers.

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs