A deep investigation into WhatsApp’s silent strategy to neutralize Arattai and the structural forces shaping India’s digital sovereignty.

Minaketan Mishra

Minaketan Mishra

On the morning of December 2025, Union Minister Ashwini Vaishnaw casually switched from WhatsApp to Zoho's Arattai during a public presentation. To most observers, it looked symbolic. To me—someone who studies business strategy as power—it was a signal flare. India's communication ecosystem had entered a new phase: a geopolitical, economic, and technological battle where messaging apps are no longer utilities but instruments of national leverage.

Within days, Arattai exploded. The app shot to #1 on the Apple App Store in India, jumping from barely 3,000 daily sign-ups to over 350,000 almost overnight . Ministers endorsed it. "Digital Swadeshi" sentiment surged. Media headlines declared it "India's answer to WhatsApp."

By January 2026, Arattai had vanished from the top charts.

And WhatsApp? It said nothing. No reaction. No statements. No counter-marketing. It simply absorbed the shockwave and watched Arattai's momentum collapse on its own.

That silence wasn't indifference.

It was strategy.

What follows is my full breakdown—grounded in geopolitics, data, and market reality—of:

This is not a fan-fiction case study. This is a forensic report based on trade shifts, policy shocks, pricing maneuvers, protocol-level encryption gaps, and platform lock-in economics, with every factual claim cited from underlying research.

Most people think WhatsApp versus Arattai is a product comparison. In reality, it's a proxy conflict shaped by the breakdown of US–India trade relations in 2025.

In August 2025, the Trump administration imposed tariffs of 25–50% on key Indian goods, triggering a 28.5% collapse in Indian exports to the US within five months. The message was clear: trade leverage would be weaponized.

This triggered Digital Swadeshi 2.0—not anti-China this time, but subtly anti–US Big Tech dependency. Ministers publicly downloaded Arattai on camera, calling it a "Made in India" alternative. Arattai benefited enormously from this political tailwind.

The government wasn't just cheerleading. It was signaling: India needs a sovereign communications backbone.

But sentiment does not defeat network effects. And that's where WhatsApp's silence was deadlier than any PR campaign.

Arattai's biggest moment was nationalistic, emotional, and sudden. Within days, everyone I knew was talking about "the Indian WhatsApp." But here's what I observed firsthand—and what Meta understood completely:

People don't move alone. They move in social clusters.

Your messaging app isn't yours. It belongs to your family, college groups, work groups, society groups, clients, vendors, and service providers. And 535 million Indians already use WhatsApp every day. That's the largest user base WhatsApp has anywhere.

If even 10 million people downloaded Arattai but their groups stayed on WhatsApp, they were effectively stranded.

Meta understood this better than anyone. It has watched Signal spike during privacy controversies and then fade. It has seen Telegram grow but fail to break WhatsApp's dominance. It has observed Koo and Hike collapse despite hype, and Sandes fail despite government backing.

So WhatsApp didn't need to fight Arattai. It only needed to wait.

This is the part almost nobody talks about, but it's the most important:

WhatsApp is India's transactional backbone.

Banks send OTPs and alerts. Insurers send policy PDFs. E-commerce apps push order tracking. MSMEs run their storefronts through WhatsApp Business. Local traders manage inventory. Service businesses coordinate logistics.

This network is economically entrenched.

When people ask "why don't Indians switch?", I remind them: switching messaging apps is equivalent to changing your phone number. Technically easy. Socially impossible.

And WhatsApp is weaponizing that entrenchment.

Based on all available evidence, WhatsApp deployed a four-pillar strategic defense, each calibrated to neutralize Arattai without appearing hostile.

Let me decode all four:

PILLAR 1 — Economic Scorched Earth: Make Switching Financially Impossible

In April–July 2025, WhatsApp introduced a radical pricing shakeup:

All confirmed from underlying pricing data.

This was not a "pricing update." This was a kill switch.

Why? Because Zoho's strength is enterprise SaaS. Arattai's path to monetization depends on becoming India's business communication layer.

But when WhatsApp makes customer support free, CFOs have zero incentive to consider Arattai—even if Arattai integrates perfectly with Zoho CRM or Desk.

WhatsApp turned enterprise messaging into a loss leader to protect its monopoly.

PILLAR 2 — The "Compliance Weaponization" Strategy

India's new SIM-binding rule (November 2025) requires messaging apps to continuously verify the physical SIM card and log out inactive sessions every 6 hours.

This rule perfectly aligns with WhatsApp's architecture (phone-number-first) and perfectly destroys Arattai's architecture (cloud-first, multi-device).

WhatsApp needs almost no change. Arattai must rewrite the engine.

Arattai users now face frequent re-logins, QR code authentication loops, and broken multi-device experience.

What the government framed as "security against digital fraud," WhatsApp quietly embraced because it crippled its cloud-native competitors.

PILLAR 3 — Interoperability Defense: Block Cross-App Messaging at All Costs

In Europe, the DMA forces WhatsApp to allow messaging across apps. If India adopted the same rule, Arattai could instantly message WhatsApp users.

That would collapse WhatsApp's network effect overnight.

So WhatsApp argues: Arattai lacks default E2EE. Therefore connecting the two would "reduce WhatsApp's security."

They're not protecting privacy—they're protecting the moat.

And technically, WhatsApp is right: Arattai does not offer default end-to-end encryption for texts, only for voice and video calls.

This is Arattai's biggest credibility gap.

PILLAR 4 — The "Super-App" Lock-In

WhatsApp is steadily integrating UPI, JioMart, ticketing, utility payments, and digital storefronts.

If users receive groceries, bills, tickets, and banking alerts all inside WhatsApp, they cannot leave. Switching becomes a commerce risk, not just a messaging inconvenience.

Arattai has none of these integrations today.

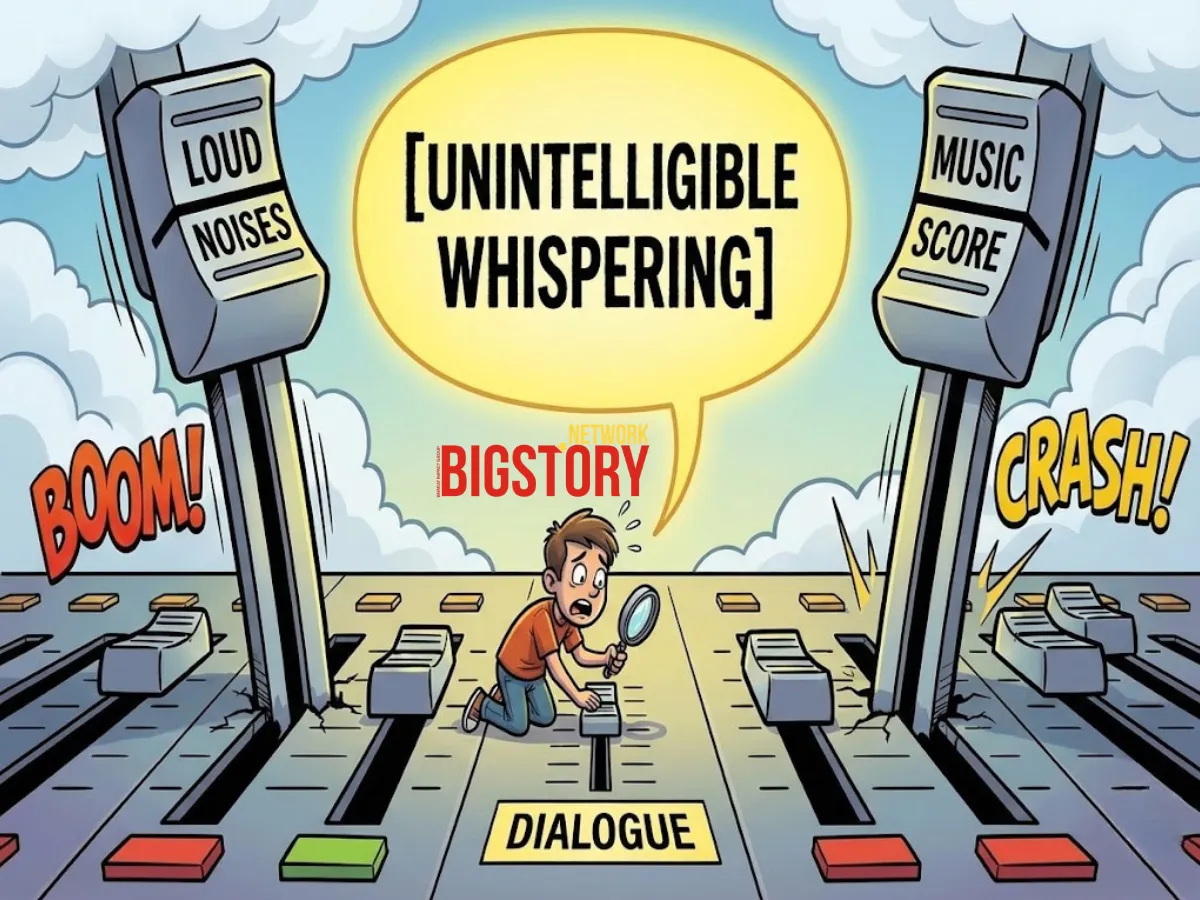

Arattai's fall from #1 to near-invisible wasn't random. Here's what I saw in community discussions, user complaints, and app-store feedback:

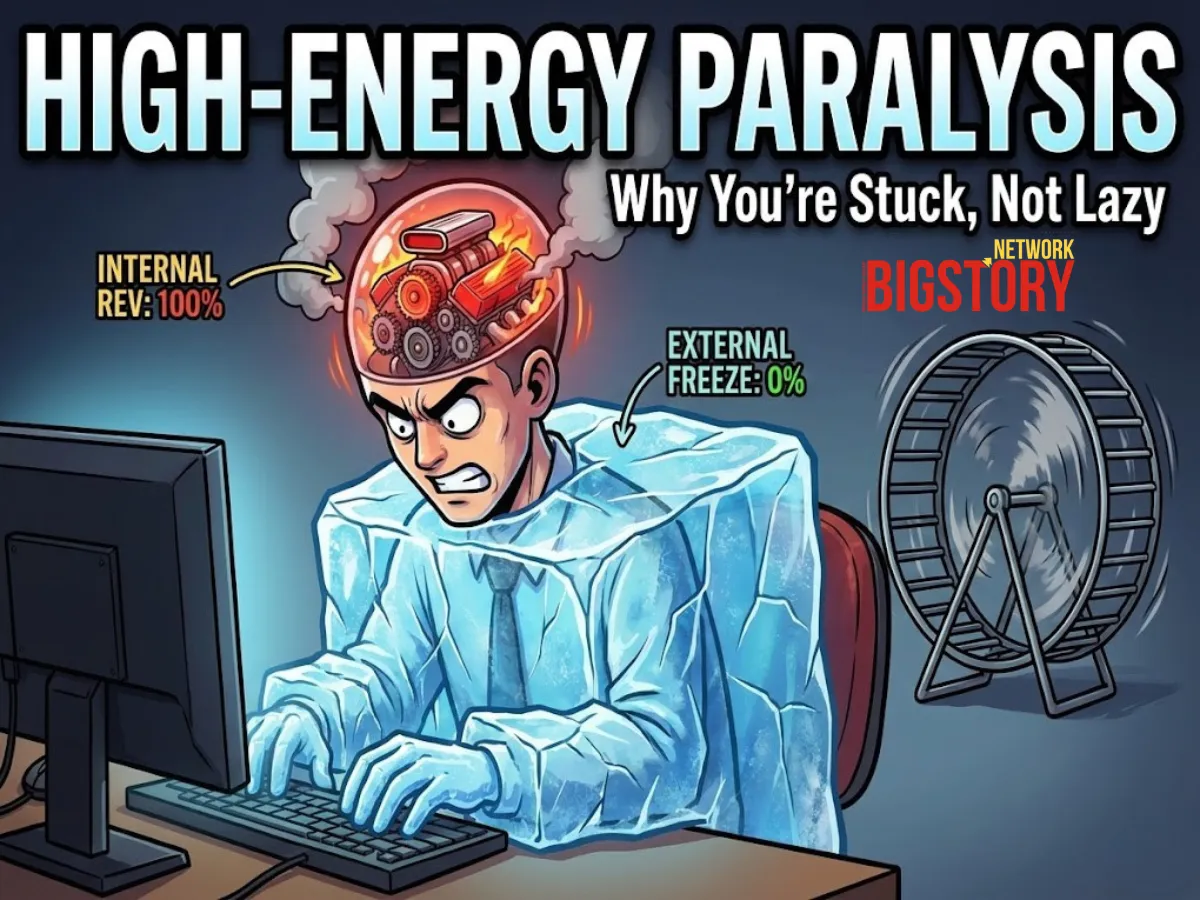

Observation 1 — Patriotism Sparks Downloads, But Doesn't Sustain Daily Use

Arattai's rise was emotional. Its decline was behavioral.

Patriotism convinces people to try an app. Convenience convinces them to stay.

Millions downloaded Arattai. But they opened the app once, found no one inside, and closed it.

This wasn't Arattai's fault. It was mathematics.

Observation 2 — Arattai Is Feature-Rich… But UI/UX Poor

Arattai genuinely has impressive features: video calls, internal team integrations, cloud sync, enterprise alignment. It feels like "Gmeet + WhatsApp."

But the UI is clunky, the flows are unintuitive, and users returning from WhatsApp feel punished.

And in India, UI isn't cosmetics—UI is adoption.

Observation 3 — The Encryption Gap Killed Trust Immediately

The moment people learned Arattai's texts aren't E2EE by default, the buzz died.

This is not a minor technical detail. It's existential.

WhatsApp's Signal protocol delivers world-class encryption. Arattai uses server-side storage unless Secret Chat is enabled.

The gap is visible, undeniable, and devastating.

Observation 4 — Zoho's Marketing Is Almost Non-Existent

Apps like Canva, Figma, and Adobe flood the internet with learning content. Arattai? Almost silent.

If you want mass adoption, every Indian must subconsciously know your brand. Arattai hasn't even begun that journey.

Observation 5 — Zoho Is Playing a 10-Year Game, Not a 10-Month Game

This is what fascinates me most.

Zoho's leadership openly admits: Arattai is a "long-term infrastructure bet." Even Zoho employees questioned why it exists. They expect years of ups and downs. Their goal is to build India's version of WeChat. They want an interoperable protocol layer, not just an app.

This patience is rare. It is the opposite of Silicon Valley's "growth at all costs" model.

Zoho is playing the sovereign stack long game.

The WhatsApp–Arattai battle reveals a paradox: India wants digital independence. But India's digital economy is built on American platforms.

The biggest danger is not WhatsApp's dominance. The danger is that India cannot achieve sovereignty without redesigning the market architecture itself.

Three insights define India's next decade:

Insight 1 — Sovereignty Requires Architectural Innovation, Not App Cloning

Zoho's work with iSpirt on open messaging protocols echoes what UPI did to payments.

If messaging becomes interoperable, no platform can monopolize. No network effect is unbreakable. No foreign entity can control communication flows.

This is India's only path to sovereignty.

Insight 2 — Switching Costs Are Structural, Not Emotional

You cannot migrate users. You must migrate graphs.

Without interoperability, every challenger fails because chats, communities, workflows, integrations, and client relationships are all tied to WhatsApp.

Insight 3 — India Must Regulate Before Platforms Become Unregulatable

The DMA forced WhatsApp's interoperability in Europe. India paused its Digital Competition Bill.

If India waits too long, WhatsApp becomes a financial layer. Commerce lock-in becomes irreversible. Any alternative becomes impossible.

This is a window—and windows close.

In this scenario:

WhatsApp becomes a quasi-public utility—not because the government mandated it, but because the market defaulted to it.

If Zoho plays the strategy correctly:

In this world, WhatsApp remains king of social messaging. Arattai becomes king of business and government messaging. A true dual-market ecosystem emerges.

Arattai cannot win as a consumer messaging app. That battle is mathematically unwinnable.

But Arattai can win as India's sovereign communication layer, India's enterprise messaging backbone, a protocol for government, regulated industries, and SMBs, and a UPI-like open standard for messaging.

Its success depends on embracing a role WhatsApp structurally cannot play because WhatsApp uses an ad-driven model Meta depends on, routes metadata through global servers, cannot become a sovereign layer, cannot open its architecture, and cannot prioritize state interests.

Arattai's path to victory lies in becoming what WhatsApp cannot—a sovereign, interoperable, enterprise-first communication protocol embedded into India's economic infrastructure.

The question is no longer: "Can Arattai replace WhatsApp?" It cannot.

The real question is: "Can India create a messaging ecosystem where no one app—Indian or American—has monopoly control over 1.4 billion people?"

If Arattai embraces this role, it doesn't need to defeat WhatsApp.

It can dismantle WhatsApp's monopoly instead.

Q1: Can Arattai dethrone WhatsApp?

No. Switching costs are too high. But Arattai can co-exist powerfully in enterprise and government.

Q2: Is WhatsApp actually under threat?

Not from users—but from regulatory shifts, sovereignty narratives, and interoperability mandates.

Q3: What is Arattai's biggest weakness?

Lack of default E2EE, poor UI, and weak marketing.

Q4: What is Arattai's biggest strength?

Zoho's patience, enterprise trust, domestic infrastructure, and sovereign alignment.

Q5: What should India focus on?

Interoperability, data portability, and competition law before lock-in becomes permanent.

SOURCES

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs