Today at the World Economic Forum in Davos, President Donald Trump formally suspended his threatened 25% tariffs on European allies, effectively ending the high-stakes standoff over his bid to purchase Greenland. The reversal came after a closed-door meeting with NATO Secretary General Mark Rutte, where Trump announced a "new security framework" instead of a land purchase.

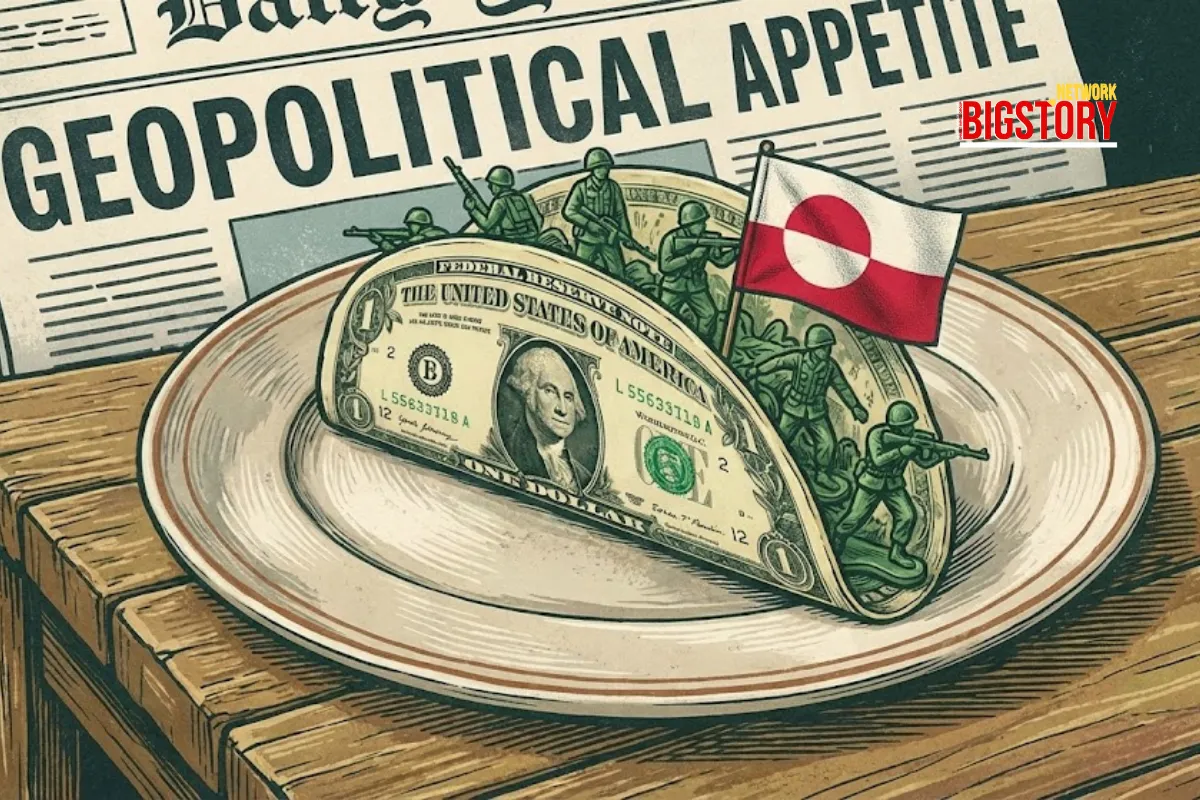

Global markets rallied instantly on the news, validating the "TACO" (Trump Always Chickens Out) theory—a dominant trading mantra on Wall Street. The theory posits that Trump’s most aggressive economic threats are often negotiating bluffs that inevitably fold under pressure, turning volatility into a buy signal for savvy traders.

The Context (How We Got Here)

- The Trigger: On January 17, Trump issued an ultimatum: Sell Greenland to the US by February 1st, or face punitive 25% tariffs on exports from Denmark, Germany, and the UK.

- The Escalation: European leaders refused to blink. On January 20, NATO allies mobilized troops for "Arctic Exercises" in Greenland, signaling a refusal to be coerced by economic threats.

- The Pivot: Facing a united European front and market jitters, Trump accepted a "security framework" deal today, claiming it provides "total access" for US defense needs without requiring a change in sovereignty.

The Key Players (Who & So What)

- Donald Trump (US President): The protagonist. He attempted to use the threat of a trade war to acquire sovereign territory. His retreat is being spun as a "deal," but critics see it as a failed bluff against a united NATO.

- Robert Armstrong (Financial Times): The originator. The financial journalist coined the "TACO" acronym, which has now become the playbook for investors dealing with Trump's second term: ignore the tweet, wait for the fold.

- Mette Frederiksen (Prime Minister of Denmark): The defender. By calling the purchase demand "absurd" and refusing to negotiate sovereignty, she forced the US President to back down, proving that the EU's collective economic weight can withstand US pressure.

The BIGSTORY Reframe (The "Tanbreez" Trojan Horse)

While the media frames this as a diplomatic loss for Trump (he didn't get the island), the economic victory might already be secured.

The "Chicken" might actually be a Fox.

- The Real Prize: Trump didn't need to own Greenland; he needed to own its minerals. The "security framework" reportedly includes guaranteed US access to the Tanbreez Rare Earth Mine.

- The Deal: The US Export-Import Bank has already issued a $120 million letter of interest for the project. By threatening tariffs, Trump likely bullied European regulators into fast-tracking these mining contracts. He didn't buy the land, but he arguably "bought" the supply chain for 1.5 million tons of rare earths essential for AI and defense.

The Implications (Why This Matters)

- Market Conditioning: The validation of the "TACO" theory sets a dangerous precedent. Markets may now completely ignore future US threats, assuming they are all bluffs. This complacency could lead to a massive crash if Trump eventually follows through on a threat.

- The AI Supply Chain: The secured access to Dysprosium and Neodymium from Greenland is a massive win for the US tech sector. These minerals are critical for high-performance magnets in AI data centers and EV motors, reducing reliance on China.

- NATO's Fragility: While the alliance held firm, the episode has left scars. A key member (USA) threatened to sanction other members (UK, Germany) over a real estate deal. The trust deficit within NATO remains high despite the "framework" announcement.

The Closing Question (Now, Think About This)

If a President threatens to bankrupt his allies to buy an island, and the market cheers because they know he won't do it, is the global economy running on policy or psychology?

FAQs

- What does TACO stand for in the stock market? It stands for "Trump Always Chickens Out." Coined by financial journalist Robert Armstrong, it is a theory suggesting that President Trump often makes aggressive economic threats (like tariffs) as a negotiating tactic but withdraws them when markets react negatively or opposition hardens.

- Did Donald Trump buy Greenland in 2026? No. After European leaders rejected his demand and mobilized NATO support, Trump accepted a "new security framework" instead of a purchase and cancelled the threatened tariffs.

- Why did Trump cancel the Greenland tariffs? He cancelled them after a meeting with NATO Secretary General Mark Rutte, citing progress on a security deal. However, market analysts believe the reversal was driven by the united European refusal to negotiate and the potential for economic blowback on the US.

- What is the Tanbreez mine mentioned in the deal? The Tanbreez project in Greenland holds one of the world's largest deposits of rare earth minerals (over 1.5 million tons). The US Export-Import Bank has signaled $120 million in support for it, aiming to secure these critical minerals for the US tech and defense sectors.

- How did markets react to the tariff cancellation? Global equity markets rallied, and gold prices stabilized. Investors viewed the reversal as a removal of immediate trade war risks and a confirmation that extreme policy threats from the US administration are often negotiable.

Sources

News Coverage

Context & Analysis

Brajesh Mishra

Brajesh Mishra

Trending Now! in last 24hrs

Trending Now! in last 24hrs