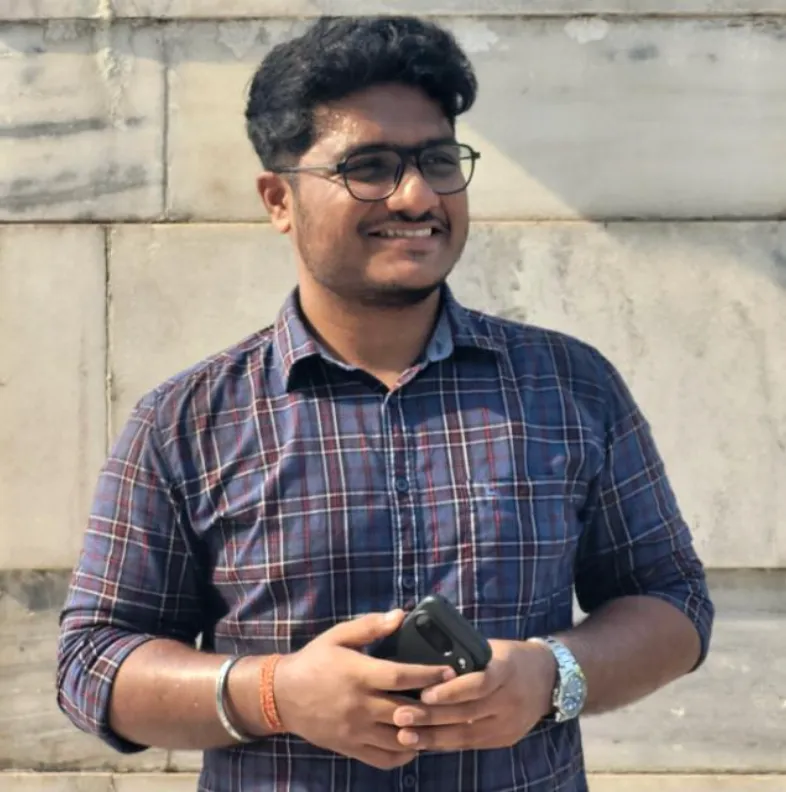

India's GDP grew at 8.2% in Q2, but the rupee plunged to a record low of 90 against the dollar. Congress chief Kharge slammed the govt for "incompetence.

Brajesh Mishra

Brajesh Mishra

In a striking economic paradox, India recorded a robust 8.2% GDP growth for Q2 FY26, beating all forecasts, just as the rupee plunged to a historic low of 90.42 against the US dollar. The currency's collapse on December 3, 2025, prompted a fierce attack from Congress President Mallikarjun Kharge, who declared "our currency has no value in the world," accusing the Modi government of "rank incompetence." This divergence highlights a critical vulnerability: while India's domestic engine is firing, its external defenses are crumbling under the weight of US tariffs and capital flight.

The crisis has been building since August, when the Trump administration imposed 50% tariffs on Indian goods, triggering a slow-motion currency shock. Despite the RBI selling nearly $30 billion in forex reserves to stem the tide, relentless foreign portfolio outflows—totaling $17 billion in 2025—have battered the rupee. The GDP data released on November 28 provided a brief respite, showing manufacturing and consumption surging, but the financial markets ignored the good news, fixating instead on the widening trade deficit and the dollar's relentless strength.

While the headlines scream "Rupee at 90," the deeper story is the "Nominal Growth Trap." India's real GDP is growing at 8.2%, but nominal growth (which includes inflation) is only 8.7%—the narrowest gap in years. This means the economy is growing in volume but not in value. For the common man, this translates to "profitless growth": businesses are selling more but earning less in dollar terms, while the cost of imported fuel, electronics, and machinery is quietly eroding their margins. The celebration of high GDP masks a silent crisis of purchasing power that no amount of government spin can fix.

The rupee's breach of the 90 mark is a psychological blow that could accelerate capital flight. Foreign investors, already jittery about tariffs, may see this as a signal to exit, fearing further depreciation will eat into their returns. For the government, a weaker rupee inflates the oil import bill, threatening to widen the fiscal deficit just as it tries to ramp up infrastructure spending. Politically, it hands the opposition a potent weapon: the argument that under the current regime, the economy is growing only for the rich, while the nation's currency—and pride—is shrinking.

If the economy is growing at a world-beating pace, why is the money in your pocket worth less to the rest of the world every single day?

Why is India's rupee falling despite strong GDP growth? The rupee's fall is driven by external factors like the strength of the US dollar, high US interest rates, and significant foreign capital outflows ($17 billion in 2025). While domestic growth (GDP) is strong at 8.2%, the external trade deficit and tariff threats from the US are weighing down the currency.

What caused the rupee to hit 90 per dollar in December 2025? A combination of persistent foreign portfolio outflows, a drop in Foreign Direct Investment (FDI), and the psychological impact of 50% US tariffs on Indian goods pushed the rupee past the 90 mark. The RBI has allowed controlled depreciation to preserve forex reserves.

How does rupee depreciation affect the common man? A weaker rupee makes imported goods like oil, electronics, and edible oils more expensive, potentially fueling inflation. However, the government has so far managed to keep headline inflation low through tax cuts and lower global commodity prices.

What did Mallikarjun Kharge say about the rupee? Congress President Mallikarjun Kharge stated that "our currency has no value in the world" and accused the Modi government of "rank incompetence," arguing that the depreciation proves the economy is in poor shape despite the high GDP figures.

News Coverage

Research & Analysis

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs