Finance Minister Nirmala Sitharaman introduced the Central Excise (Amendment) Bill 2025 to replace the expiring GST Compensation Cess on tobacco, maintaining current prices.

Brajesh Mishra

Brajesh Mishra

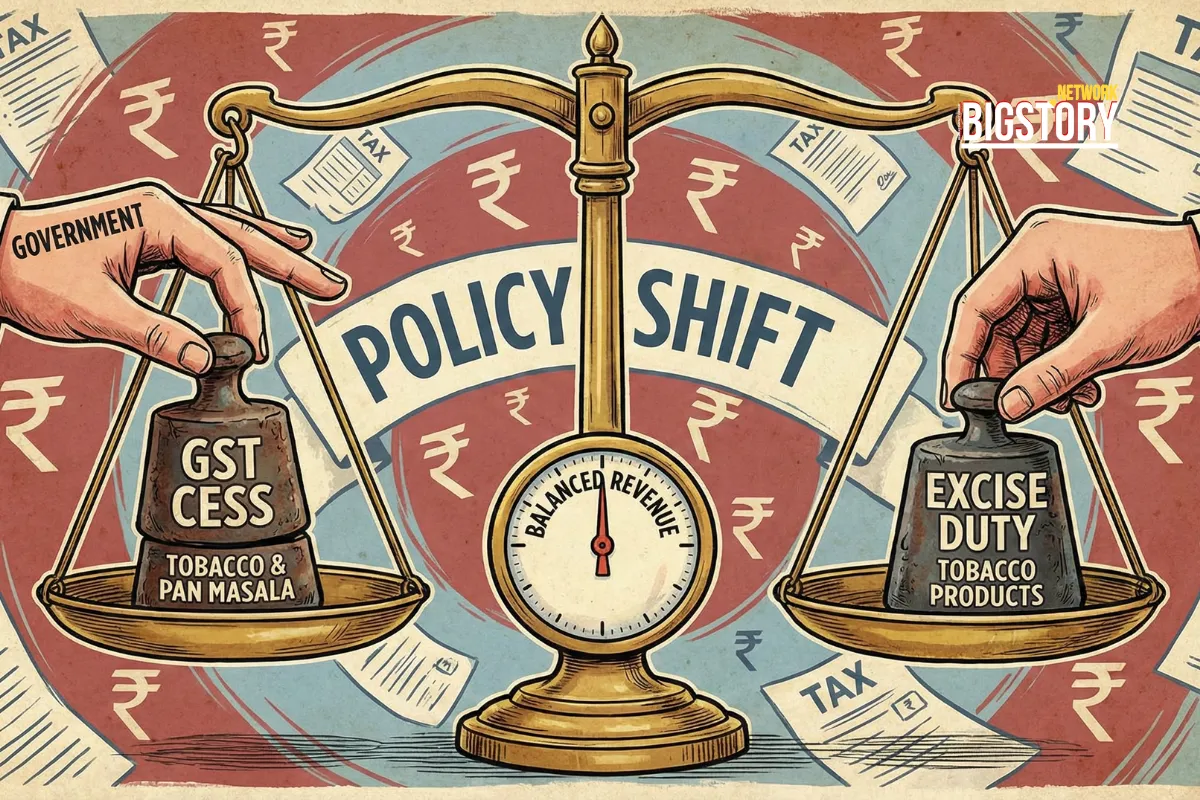

Finance Minister Nirmala Sitharaman introduced the Central Excise (Amendment) Bill, 2025 in the Lok Sabha today, moving to replace the expiring GST Compensation Cess on tobacco with a new, permanent Central Excise Duty. This legislative fix aims to maintain "revenue neutrality"—meaning cigarette and pan masala prices will remain unchanged. The urgency stems from the December 2025 deadline, when the loans taken to compensate states for GST losses will be fully repaid, legally ending the existing "Compensation Cess" regime. Without this bill, the tax burden on tobacco would have plummeted, causing a sudden drop in prices and a massive revenue loss for the exchequer.

Since 2017, a "Compensation Cess" was levied over and above the 28% GST on tobacco to fund state revenue shortfalls. This levy was set to expire in March 2026, but with the underlying loans being paid off early (by Dec 2025), the legal basis for collecting the cess vanishes this month. To prevent a vacuum, the government is essentially renaming the "Cess" as "Excise Duty" for tobacco and introducing a separate "Health Security Cess" for pan masala. This ensures the total tax incidence remains high (up to 70% + GST) without needing constant constitutional amendments.

While the headlines focus on "cigarette prices," the deeper story is the "Centralization of the Sin Tax." By converting the GST Cess (which was a temporary, shared burden) into a Central Excise Duty (for tobacco) and a Health Security Cess (for pan masala), the Union Government is subtly reclaiming fiscal territory it ceded during the GST rollout. The new "Health Security Cess" on pan masala is particularly strategic: as a "cess," its proceeds go 100% to the Centre, bypassing the Finance Commission's formula that mandates sharing 41% of taxes with states. It’s a masterclass in fiscal federalism—maintaining the price for the consumer, but changing who gets to keep the money.

For the consumer, the immediate impact is zero—cigarette prices won't drop. But for the industry, the landscape shifts from a rigid GST regime to a more flexible Excise regime, where the Finance Minister can tweak rates annually in the Union Budget. This reintroduces "budget day anxiety" for the tobacco sector. Additionally, the new machine-capacity based tax on pan masala signals a tech-driven crackdown on evasion, likely forcing smaller, unorganized players out of business.

If the tax you pay stays the same, but the state government stops getting a share of it, did the price really stay unchanged?

Will cigarette prices increase after the Central Excise Bill 2025?

Likely not immediately. The bill is designed to be "revenue neutral," meaning it replaces the expiring GST Compensation Cess with an equivalent Central Excise Duty to prevent a price drop, rather than to hike prices right now.

What is the 'Health Security se National Security Cess'?

It is a new cess proposed on products like pan masala and gutkha. It will be levied based on the machine capacity of the manufacturer (deemed production) to curb tax evasion, replacing the old GST compensation cess mechanism.

Why is the government removing the GST Compensation Cess?

The GST Compensation Cess was levied to repay loans taken to compensate states for revenue loss during the GST transition. Since those loans will be fully repaid by December 2025, the legal basis for the "Compensation Cess" expires, requiring a new law to maintain the tax level.

How does this affect companies like ITC?

While the tax burden remains theoretically the same, the shift to "Excise Duty" gives the central government more flexibility to increase taxes in future annual budgets, introducing a layer of long-term regulatory risk for tobacco companies.

News Coverage

Research & Analysis

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs