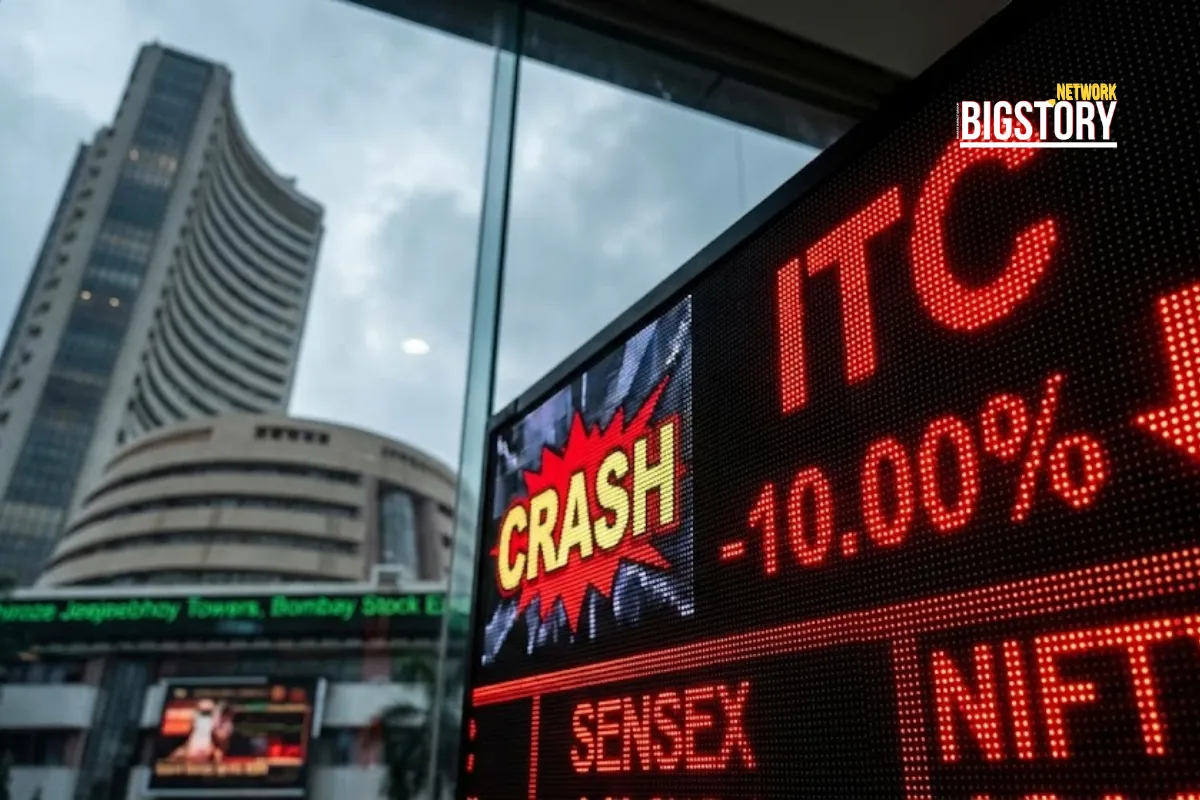

ITC stock crashes 10% after government hikes cigarette excise duty. ₹50k crore lost. Analysts predict price hikes. Read the full analysis.

Brajesh Mishra

Brajesh Mishra

The Indian stock market kicked off 2026 with a jolt for tobacco investors. On January 1, shares of ITC Limited plunged 10% to hit a 52-week low of ₹362.70, wiping out nearly ₹50,000 crore in market capitalization in a single trading session. The sell-off was triggered by a New Year's Eve notification from the Finance Ministry imposing a sharp hike in excise duty on cigarettes, effective February 1, 2026. This new levy, ranging from ₹2,050 to ₹8,500 per 1,000 sticks, comes on top of the 40% GST framework introduced in September, dealing a double blow to the industry’s margins.

This policy shift has been brewing for months. In September 2025, the government restructured the GST framework with a punitive 40% "sin tax." Then, on November 30, Finance Minister Nirmala Sitharaman hinted at a new cess to replace the expiring GST Compensation Cess, promising "unchanged tax incidence." However, the final notification on December 31 revealed a tax burden that analysts estimate will increase production costs by 22-28%. Compounding the panic, a massive block deal of 4 crore shares was executed at ₹400 just as the market opened, amplifying the downward spiral. For ITC, which had already seen negative returns in 2025, this regulatory curveball marks its worst trading day in six years.

While mainstream coverage focuses on the stock crash, the deeper story is the "Tax Neutrality Illusion." The government claimed the new structure would keep the tax burden "unchanged" by merely swapping one cess for another. The market's violent reaction suggests otherwise. Investors are betting that the combined impact of the new excise duty plus the cascading effect of GST will actually increase the net tax burden significantly. This isn't just a swap; it’s likely a stealth tax hike disguised as administrative cleanup.

Furthermore, the "Illicit Market Trap" is the elephant in the room. If ITC is forced to raise prices by 20%, the price gap between legal cigarettes and smuggled/illicit alternatives widens drastically. In a price-sensitive market like India, this policy might inadvertently boost the black market—hurting both ITC's volumes and the government's tax collections in the long run.

For the 35 lakh retail investors holding ITC as a "safe" dividend stock, this crash is a wake-up call about regulatory risk. For the company, the next month is critical: management must decide how much of the tax hike to pass on to consumers before the February 1 deadline. A full pass-through protects margins but risks volume; absorbing it protects volume but kills profits. It’s a lose-lose choice engineered by policy.

If the government’s goal is to discourage smoking through taxes, why does the policy seem to be encouraging the black market instead?

Why did ITC stock crash on January 1, 2026? ITC shares plunged 10% after the Finance Ministry announced a new excise duty on cigarettes ranging from ₹2,050 to ₹8,500 per 1,000 sticks. This new tax, effective February 1, comes on top of the existing 40% GST, significantly increasing the company's tax burden and sparking fears of margin compression.

How much will cigarette prices increase due to the excise duty? Analysts estimate that ITC may need to raise retail cigarette prices by 15-20% to pass on the increased tax burden to consumers. For popular cigarette sizes, this could mean a hike of ₹2-3 per stick.

Is ITC stock a buying opportunity after the crash? Opinions are mixed but cautious. While the stock is at a 52-week low, brokerage firms like Nuvama have downgraded it to "hold," citing volume growth concerns. However, some investors argue that ITC's diversified non-tobacco businesses (hotels, FMCG) provide long-term stability despite the cigarette tax headwinds.

News Coverage

Market Analysis

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs