The signing of the India-EU Free Trade Agreement (FTA) on January 27, 2026, has triggered "panic mode" in Dhaka and Islamabad. The pact, described by EU Commission President Ursula von der Leyen as the "mother of all deals," promises to eliminate import duties on Indian textiles (currently 9-12%) over the next 5-7 years.

This development effectively neutralizes the tariff advantages long enjoyed by Bangladesh (under LDC/EBA status) and Pakistan (GSP+). For the first time in decades, Indian apparel will compete on a level playing field in Europe—the world’s largest fashion market—threatening to displace billions of dollars in exports from its neighbors who relied on their duty-free edge to undercut Indian prices.

The Context (How We Got Here)

- The "Preference" Era (2014-2024): For the last decade, Pakistan enjoyed GSP+ status (zero duty on 66% of goods), and Bangladesh used Everything But Arms (EBA) access to dominate EU markets. Indian exporters, paying ~9.6% duty, were priced out of low-margin segments like t-shirts and denim.

- The Timeline Clash:

- Jan 27, 2026: India signs the FTA, locking in a path to 0% duties.

- Nov 2026: Bangladesh is scheduled to graduate from LDC status. While it has a 3-year grace period (until 2029), it faces a "tariff cliff" of ~12% thereafter, just as India's duties drop to zero.

- Dec 2027: Pakistan’s current GSP+ cycle expires, with renewal uncertain due to stricter EU compliance norms on human rights.

The Key Players (Who & So What)

- Dr. Gohar Ejaz (Former Commerce Minister, Pakistan): The Whistleblower.

- Relevance: He issued a stark public warning to the Shehbaz Sharif government this week.

- Quote: "The decision must be taken today – $9 billion exports to EU and 10 million jobs are at risk... our zero-tariff honeymoon is over."

- Mustafizur Rahman (Distinguished Fellow, CPD Bangladesh): The Analyst.

- Relevance: Leading economist warning of "competitive erosion." He notes that without a tariff shield, Bangladesh’s reliance on imported raw materials makes it vulnerable to India’s integrated supply chain.

- Quote: "Bangladesh will become less competitive in the EU market once India secures duty-free access."

- Ursula von der Leyen (President, European Commission): The Architect.

- Relevance: Positioned the deal as a "geopolitical necessity" to de-risk supply chains from China. By integrating India, the EU aims to replace Chinese volume with Indian volume, leaving smaller players like Pakistan squeezed in the middle.

The BIGSTORY Reframe (The "Vertical Integration" Killer)

Mainstream media is focusing on the 12% Tariff Drop. The real story is Supply Chain Sovereignty.

- The "Cotton-to-Consumer" Monopoly: Tariffs are only half the battle. The FTA incentivizes strict "Rules of Origin" (requiring "double transformation"—fiber to fabric to garment).

- India grows its own cotton (world’s largest producer) and makes its own yarn, easily meeting these rules to claim 0% duty.

- Bangladesh imports nearly 90% of its cotton and substantial yarn/fabric (often from India or China). Post-LDC graduation, meeting the "double transformation" rule for GSP+ will be a nightmare. India isn't just winning on tax; it's winning because it owns the farm and the factory.

- The Digital Barrier: The deal includes cooperation on Digital Product Passports (DPP). India’s aggressive adoption of AI-driven traceability (via its "India Stack") allows it to meet the EU’s new "Green Deal" norms faster. Pakistan and Bangladesh, lagging in digital compliance, face a non-tariff wall that is harder to climb than a tax wall.

The Implications (Why This Matters)

- For Pakistan: The textile sector accounts for 60% of national exports. A loss of market share in the EU could precipitate a balance-of-payments crisis, forcing further dependence on IMF bailouts.

- For Bangladesh: The "Price Gap" could swing by 24% by 2029 (India goes down 12%, Bangladesh goes up 12%). This existential threat is driving Dhaka to urgently seek a separate FTA with Brussels, though they are years behind in negotiations.

- For European Brands: Major buyers (Zara, H&M) are likely to shift long-term sourcing contracts to India to consolidate risk. Why buy cotton from India and sew it in Dhaka (two jurisdictions) when you can do both in Tiruppur (one jurisdiction, zero duty)?

The Closing Question (Now, Think About This)

If your entire economic model relies on a tax break that your neighbor just neutralized, do you have a competitive industry, or just a subsidized one?

FAQs: Decoding the Textile Trade War

1. How will the India-EU FTA affect Pakistan's textile exports? The deal eliminates the 9-12% import duty Indian textiles currently face in the EU. This neutralizes the advantage Pakistan enjoys under GSP+ (zero duty). Since Indian manufacturers often have lower raw material costs (domestic cotton), they can now undercut Pakistani exporters on price, putting ~$9 billion of Pakistan's exports at risk.

2. What is the tariff difference between India and Bangladesh for EU exports?

- Currently: Bangladesh pays 0% (LDC status); India pays ~9.6%.

- Post-FTA (by 2027-29): India will pay 0%.

- Post-2029: Bangladesh (after LDC grace period ends) could face ~12% MFN tariffs unless it negotiates a new deal.

- Result: A potential 21-22% price swing in India's favor.

3. When will the India-EU Free Trade Agreement be implemented? The deal was signed on January 27, 2026. It now goes for ratification by the European Parliament and Indian Parliament. Implementation is expected to begin by early 2027, with tariff reductions phasing in over 5-7 years.

4. What is "Double Transformation" in Rules of Origin? It is a rule requiring that at least two major manufacturing steps (e.g., spinning yarn and weaving fabric) happen within the exporting country to qualify for duty-free access. India (which grows cotton and spins yarn) easily meets this. Bangladesh (which imports yarn) struggles with this rule, often relying on "Single Transformation" waivers available only to LDCs.

5. Why is this called the "Mother of All Deals"? EU Commission President Ursula von der Leyen used this term because of the sheer scale. The deal covers a market of 1.4 billion people (India) and a €16 trillion economy (EU), acting as a massive geopolitical counterweight to China's Belt and Road Initiative.

Sources

News Coverage

Context & Analysis

Sseema Giill

Sseema Giill

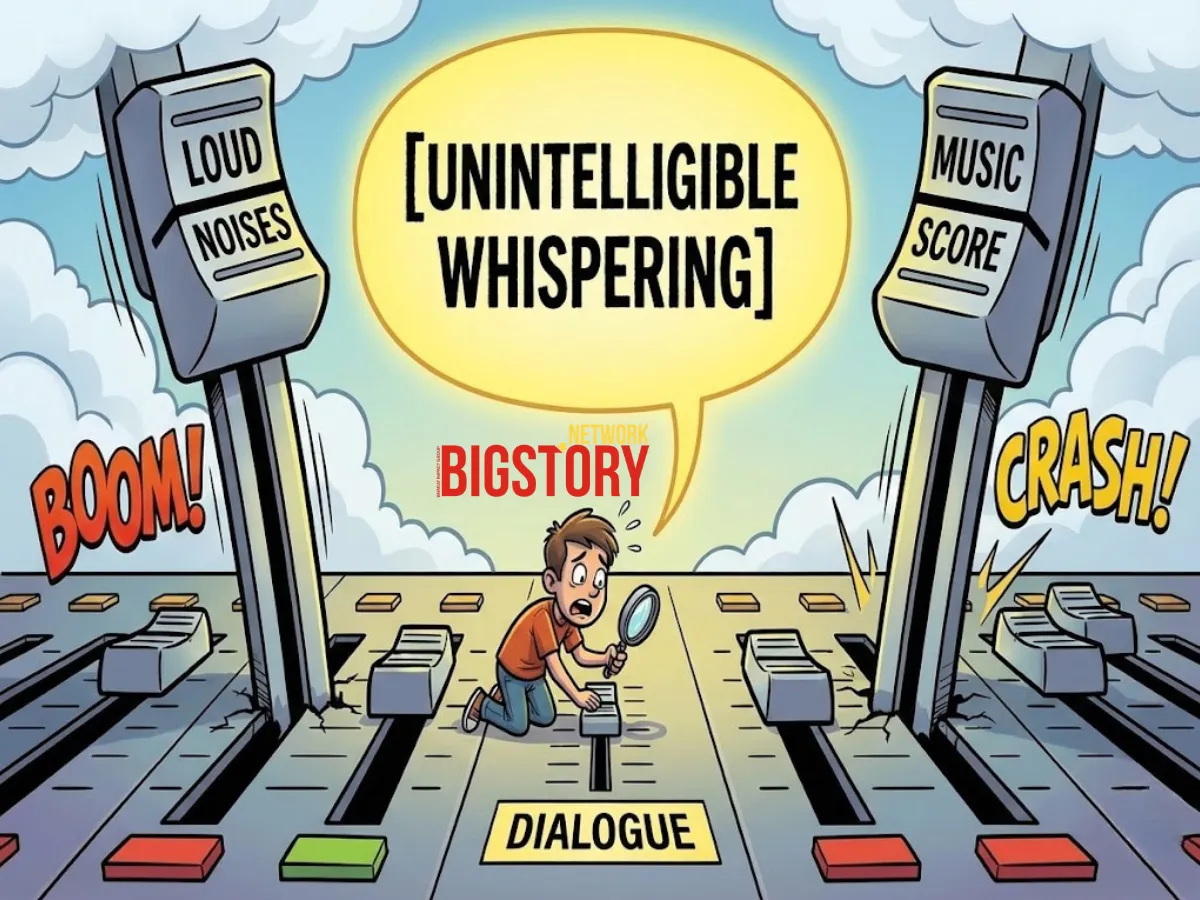

Trending Now! in last 24hrs

Trending Now! in last 24hrs