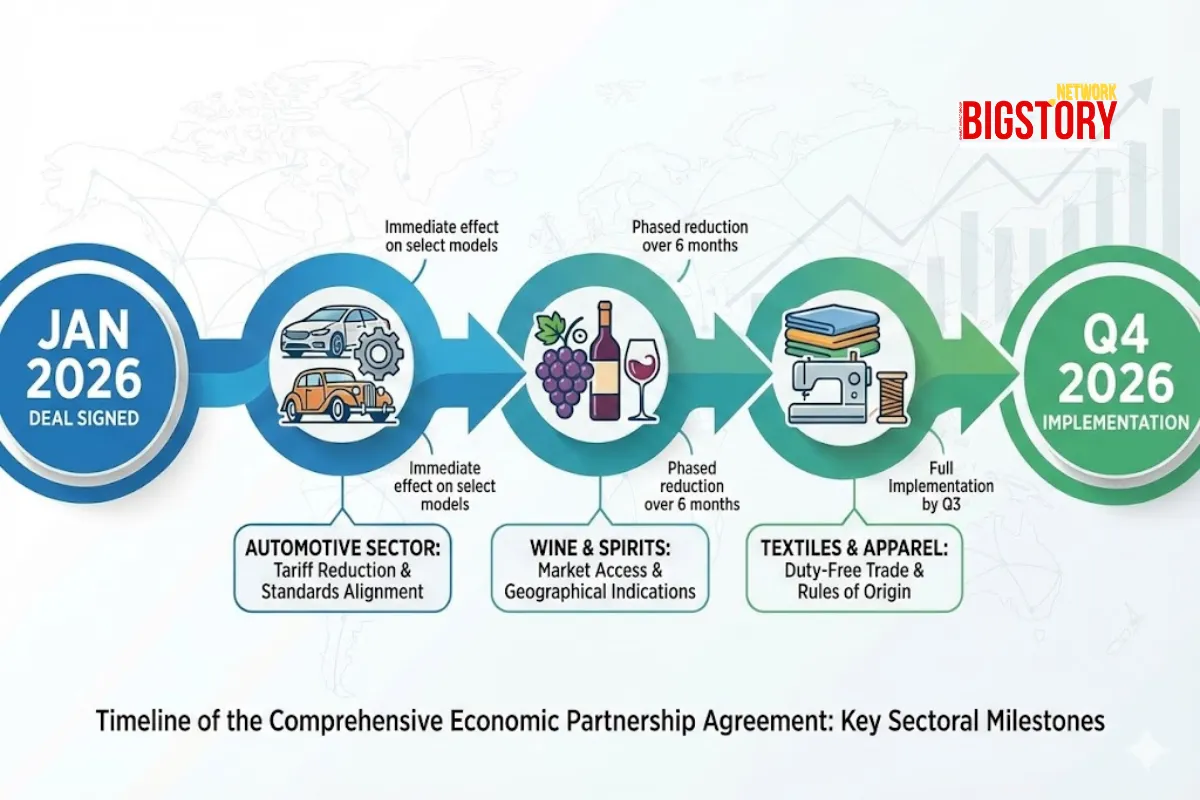

Following the historic conclusion of negotiations on January 27, 2026, Commerce Minister Piyush Goyal has confirmed that India and the European Union are fast-tracking the "legal scrubbing" process to ensure the Free Trade Agreement (FTA) is formally signed and implemented by late 2026.

The deal, dubbed the "Mother of All Deals" by EU Commission President Ursula von der Leyen, is being rushed to operationalize tariff cuts before the new "Trump Tariffs" (US universal baseline duties) fully kick in next year. The urgency stems from a strategic need to insulate Indian exporters by opening a duty-free corridor to Europe just as the American market becomes more expensive.

The Context (How We Got Here)

- The Stalemate (2007-2013): Original negotiations stalled for years over "deal-breaker" issues like high Indian tariffs on European automobiles and wines.

- The Relaunch (2022): Talks were formally relaunched in June 2022 with a renewed focus on supply chain diversification away from China ("China Plus One" strategy).

- The Breakthrough (Jan 27, 2026): Negotiations concluded in New Delhi, creating a free trade zone of 2 billion people.

- Current Status (Jan 31, 2026): Legal texts are being finalized. The deal now awaits ratification by the European Parliament, with a target "Entry into Force" date of Q4 2026, slashing the usual 18-month ratification timeline to just 6-8 months.

The Key Players (Who & So What)

- Piyush Goyal (Commerce Minister, India): The Negotiator. He successfully protected India's sensitive dairy and agriculture sectors while securing zero-duty access for textiles. He is now pushing for a "record-breaking" ratification timeline to lock in gains.

- Ursula von der Leyen (President, EU Commission): The Partner. She prioritized this deal to unlock the Indian market for German automakers and French wine producers, framing it as a geopolitical pivot to the Indo-Pacific to counter Chinese influence.

- KPR Mill & Gokaldas Exports: The Beneficiaries. These major Indian textile firms saw their stock prices rally ~12% this week. They anticipate a 12% margin expansion as EU import duties drop to zero, allowing them to compete directly with Bangladesh and Vietnam.

The BIGSTORY Reframe (The "Service Sector" Backdoor)

While the media headlines focus on "Cars for Clothes," the real game-changer is the Services Chapter.

- People for Products: The deal opens 144 service sub-sectors in the EU to Indian professionals, including accountants, nurses, architects, and IT consultants. This "Mobility Partnership" is India's long-term strategic win. It effectively creates a "Visa Fast Track" for Indian talent to plug Europe's demographic labor shortage.

- Data as Currency: The FTA includes a "Digital Trade" chapter that harmonizes data flow standards. This positions India as a "Trusted Data Partner" for the EU (unlike China), crucial for India’s IT sector to export "AI-as-a-Service" to Europe without hitting GDPR roadblocks.

The Implications (Why This Matters)

- For Car Buyers: A quota of 250,000 European cars will now enter India annually at a reduced 10% duty (down from 110%). This is a massive win for luxury buyers (Mercedes, BMW, Audi) but remains a quota-based system to protect mass-market players like Tata and Maruti.

- For Wine Lovers:

- The deal slashes duties on European wines, likely lowering prices of French and Italian labels in India. While good for consumers, this poses a competitive threat to local vineyards in Nashik, who may need to pivot to premiumization.

- For Exporters: While tariffs drop, non-tariff barriers remain. The Carbon Border Adjustment Mechanism (CBAM) will still apply. Indian steel and cement exporters must comply with EU carbon reporting, or the duty benefits will be nullified by carbon taxes.

The Closing Question (Now, Think About This)

If Europe is opening its doors to Indian talent to fix its aging workforce crisis, is this FTA a trade deal, or a demographic rescue package?

FAQs: Decoding the India-EU FTA

1. When will the India-EU FTA be implemented? The target date for implementation ("Entry into Force") is late 2026 (Q4). Both sides are fast-tracking the legal scrubbing and ratification process to ensure benefits kick in before 2027.

2. Will European cars become cheaper in India?Yes, but with limits. Luxury European cars will see import duties slashed from 110% to 10%. However, this applies only to a quota of 250,000 units per year. Once the quota is filled, standard rates may apply.

3. Does the FTA cover the Carbon Tax (CBAM)?No. There is no explicit exemption from the EU's Carbon Border Adjustment Mechanism (CBAM). However, the deal establishes a cooperation framework to help Indian exporters comply with these green norms to avoid penalties.

4. What does the "Negative List" mean for Dairy? It means European milk, cheese, and butter will NOT get duty-free access to India. Negotiators successfully placed these items on the "Negative List" to protect Indian farmers and cooperatives like Amul from cheap imports.

5. How does this benefit the textile sector? Currently, Indian textiles face a 9-12% import duty in the EU, while Bangladesh (LDC status) pays zero. This FTA removes that duty for India, leveling the playing field and likely boosting orders for Indian exporters by 20%.

Sources

News Coverage

Context & Analysis

Brajesh Mishra

Brajesh Mishra

Trending Now! in last 24hrs

Trending Now! in last 24hrs