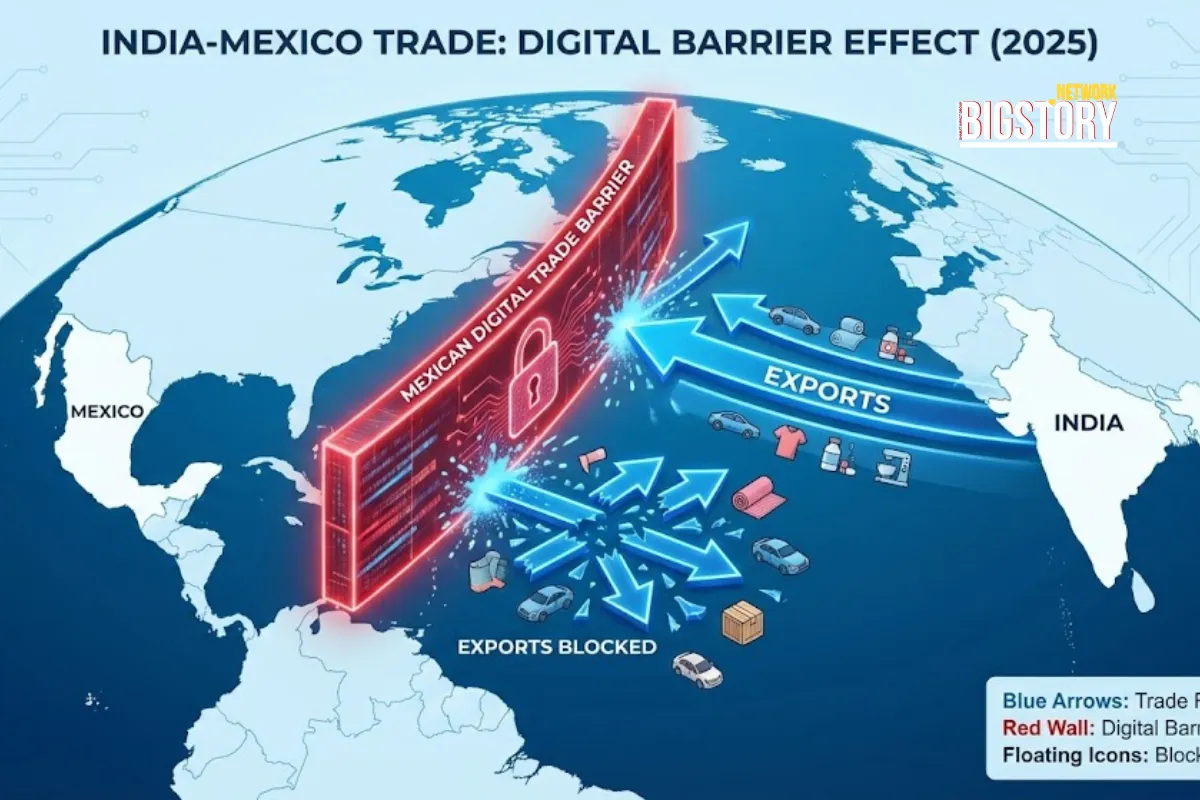

Mexico has approved 50% tariffs on Indian goods, putting $1 billion in auto exports at risk. The move aligns with US protectionism and hits carmakers like Skoda and Hyundai.

Sseema Giill

Sseema Giill

In a major blow to Indian exporters, Mexico's Senate approved a sweeping tariff hike on December 11, 2025, imposing duties of up to 50% on goods from countries without free trade agreements, including India and China. The move, effective January 1, 2026, targets over 1,400 product categories, with the automotive sector facing the steepest increase—from 20% to 50%. This decision places approximately $1 billion of India's annual auto exports to Mexico in jeopardy, directly impacting manufacturers like Skoda Auto Volkswagen India, Hyundai, and Maruti Suzuki.

This escalation is a ripple effect of the global trade war ignited by US President [Donald Trump]. After the US imposed 50% tariffs on Indian goods in August 2025, citing trade imbalances and Russian oil purchases, Mexico faced pressure to align its trade policy with its northern neighbor. President Claudia Sheinbaum proposed the hikes in September to protect domestic industries and narrow the fiscal deficit. Despite urgent lobbying by the Society of Indian Automobile Manufacturers (SIAM) arguing that Indian compact cars do not compete with Mexican high-end exports, the Mexican government proceeded, driven by the need to secure its standing in the upcoming USMCA review.

While headlines focus on "protectionism," the deeper story is the "Nearshoring Trap." Mexico positioned itself as the ideal "China +1" partner for the West, but by imposing 50% tariffs on the very Asian inputs (like auto parts and steel) needed for its manufacturing, it risks shooting its own industrial base in the foot. For India, this reveals a harsh reality: in a world of regional trading blocs (like USMCA), being a "non-aligned" trading partner means being vulnerable. The Indian government's silence—issuing no official counter-statement—suggests a strategic paralysis in the face of a coordinated North American trade squeeze.

For Indian automakers, Mexico was a key growth market, accounting for 12-14% of exports for companies like Nissan India. A 50% tariff makes their cars uncompetitive overnight, potentially forcing production cuts in Pune and Chennai. This could accelerate a strategic pivot to other markets like Africa or South America. Globally, it signals that the era of open trade is over; even "friendly" nations like Mexico are raising walls, forcing India to rethink its export-led growth strategy in a fragmented world.

If Mexico builds a wall against Indian cars to please the US, has the trade war just become a global trade quarantine?

News Coverage

Research & Analysis

Why did Mexico impose tariffs on India? Mexico imposed tariffs of up to 50% on goods from countries without free trade agreements to protect its domestic industries, raise revenue to narrow its fiscal deficit, and align with US pressure to curb imports from Asian nations, particularly China. India is collateral damage in this broader policy shift.

How will Mexico's tariff affect Indian car exports? The tariff on passenger vehicles has jumped from 20% to 50%. This will make Indian-made cars significantly more expensive in Mexico, likely causing a sharp drop in sales. Indian automakers export about $1 billion worth of vehicles to Mexico annually, with companies like Skoda Auto Volkswagen and Hyundai being major contributors.

Is India negotiating with Mexico for an exemption? While industry bodies like SIAM have urged the Indian Commerce Ministry to intervene, there has been no official confirmation of high-level diplomatic negotiations or a trade deal to exempt Indian goods from these new tariffs as of December 2025.

When do the new tariffs take effect? The new tariff regime approved by the Mexican Senate is scheduled to come into effect on January 1, 2026.

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs