Union Budget 2026 preview: Nirmala Sitharaman may replace the Income Tax Act 1961. Analysis of the 7.4% growth forecast and election-year allocations.

Brajesh Mishra

Brajesh Mishra

On Sunday, February 1, 2026, Finance Minister Nirmala Sitharaman will rise in Parliament to present her 9th consecutive Union Budget, breaking records and perhaps, breaking the mold. While the timing—a rare Sunday session—is unusual, the economic backdrop is even more distinct. With real GDP growth projected at a robust 7.4% for FY26, India is in what economists call a "Goldilocks" phase. However, this is not merely an accounting exercise; it is a political tightrope walk. Facing critical assembly elections in five states including West Bengal and Tamil Nadu, the Modi 3.0 government must balance populist demands with a strict fiscal deficit target of 4.5%.

This is the second full budget of the Modi 3.0 era, and the expectations are shifting from "post-pandemic recovery" to "structural acceleration." The Budget Session, beginning January 28, will likely set the stage for the Viksit Bharat (Developed India) roadmap. The pressure points are visible: urban inflation has squeezed the middle class, creating a clamor for tax relief. Simultaneously, the southern and eastern states going to polls in Q2 2026 are demanding specific "corridor" allocations. The government’s challenge is to deliver growth without overheating the economy, maintaining the fiscal glide path while keeping the voter happy.

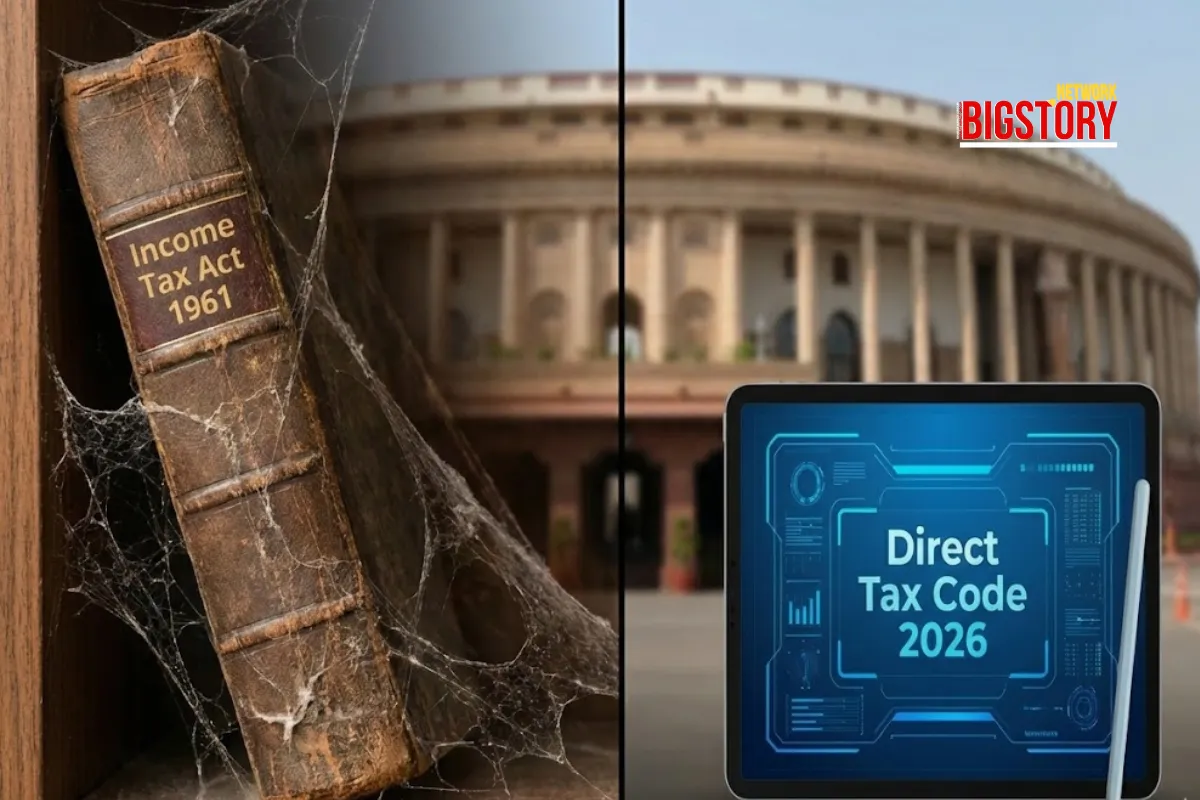

While mainstream media obsesses over "Section 80C limits" and "Tax Slabs," the deeper story is the "Code Breaker." Sources suggest this budget might signal the end of the archaic Income Tax Act of 1961, potentially replacing it with a streamlined Direct Tax Code (DTC). This is not just a tweak; it is a rewriting of India's tax DNA. The goal is radical simplification—making the tax code intelligible to the average citizen and reducing litigation. However, the "BigStory" catch is the trade-off: a new code typically means the elimination of complex exemptions. The narrative isn't just "lower taxes"; it is "simpler taxes, but fewer loopholes."

Furthermore, the "Sovereign AI Shift" is critical. We anticipate a move from subsidizing software startups to building "Sovereign Compute" infrastructure. Expect the budget to treat Artificial Intelligence not as a service sector, but as public infrastructure—allocating funds for state-backed GPU clusters under the IndiaAI Mission. This positions AI as a strategic asset, akin to highways or power grids.

The Implications (Why This Changes Things)

If the DTC is introduced, it fundamentally alters financial planning for every Indian household, prioritizing the "New Regime" (no exemptions, lower rates) as the only future path. Regionally, watch for "Purvodaya" allocations for West Bengal and industrial corridors for Tamil Nadu—these aren't just development projects; they are election manifestos funded by the central exchequer.

The Closing Question (Now, Think About This)

If the government simplifies the tax code to make it "exemption-free," are you ready to trade your HRA and 80C deductions for a lower flat rate?

Will the Income Tax Act 1961 be replaced in Budget 2026? There is strong speculation that Finance Minister Nirmala Sitharaman may introduce a new Direct Tax Code (DTC) to replace the 65-year-old Income Tax Act. The aim is to simplify tax laws, reduce litigation, and likely phase out the complex web of exemptions in favor of lower, flatter rates.

Is the standard deduction increasing for salaried employees in 2026? While not confirmed, raising the standard deduction is a high-probability expectation to provide relief to the middle class amidst inflation. Analysts predict an increase from the current ₹75,000 to potentially ₹1 lakh, especially under the New Tax Regime, to make it more attractive.

Which states will get special packages in Budget 2026? Budget 2026 is expected to favor states heading for elections in Q2 2026, specifically West Bengal, Tamil Nadu, Kerala, and Assam. Expect announcements related to the "Purvodaya" initiative for the East and specific industrial or defence corridor allocations for Tamil Nadu.

Will the Income Tax Act 1961 be replaced in Budget 2026? There is strong speculation that Finance Minister Nirmala Sitharaman may introduce a new Direct Tax Code (DTC) to replace the 65-year-old Income Tax Act. The aim is to simplify tax laws, reduce litigation, and likely phase out the complex web of exemptions in favor of lower, flatter rates.

Is the standard deduction increasing for salaried employees in 2026? While not confirmed, raising the standard deduction is a high-probability expectation to provide relief to the middle class amidst inflation. Analysts predict an increase from the current ₹75,000 to potentially ₹1 lakh, especially under the New Tax Regime, to make it more attractive.

Which states will get special packages in Budget 2026? Budget 2026 is expected to favor states heading for elections in Q2 2026, specifically West Bengal, Tamil Nadu, Kerala, and Assam. Expect announcements related to the "Purvodaya" initiative for the East and specific industrial or defence corridor allocations for Tamil Nadu.

News Coverage

Context & Analysis

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs