China files a second WTO dispute against India in Dec 2025, challenging solar subsidies and ICT tariffs. Beijing claims India's policies violate trade rules.

Brajesh Mishra

Brajesh Mishra

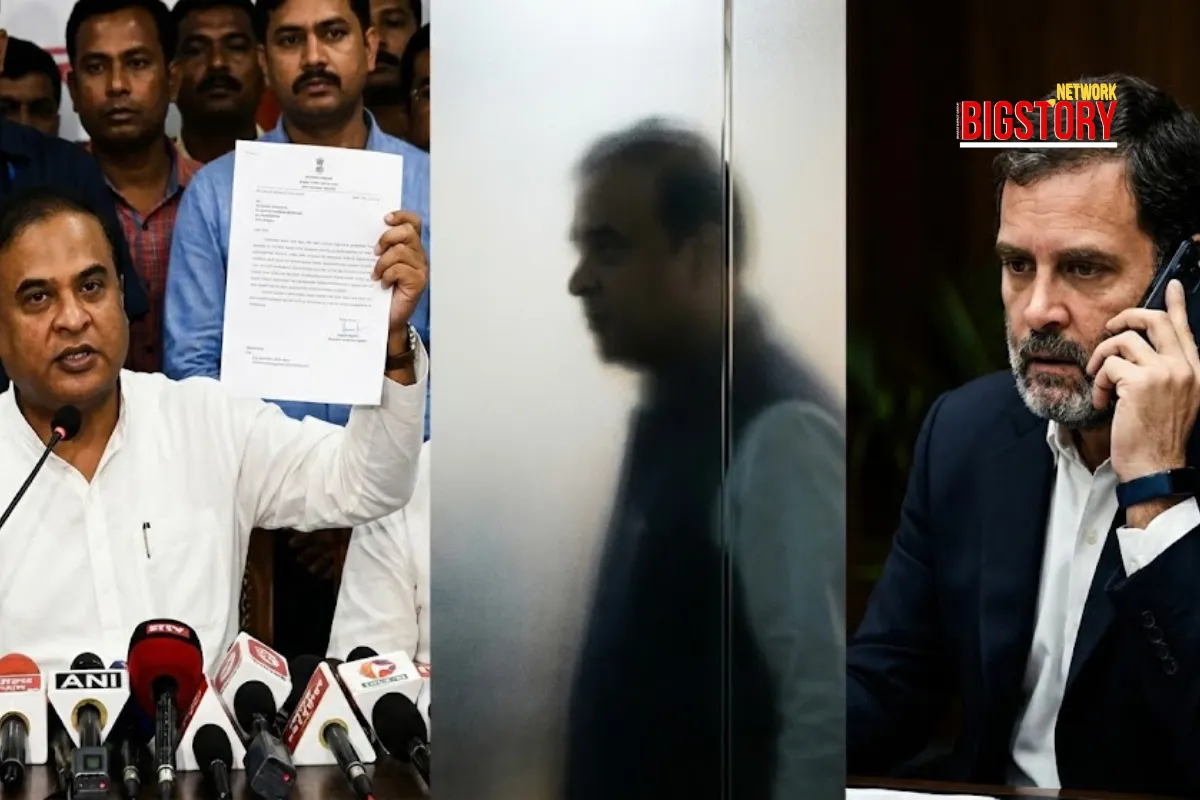

The trade war between Asia’s two giants has moved from the border to the courtroom. On December 19, 2025, China formally requested dispute consultations with India at the World Trade Organization (WTO), alleging that New Delhi’s tariffs on Information and Communication Technology (ICT) products and subsidies for the solar power sector violate global trade rules. This complaint marks a significant escalation, coming just two months after Beijing challenged India’s Production Linked Incentive (PLI) schemes for EVs. China claims these measures are discriminatory "import substitution subsidies" designed to unfairly block Chinese goods from the Indian market.

This dispute is not an isolated incident; it is part of a calculated legal offensive. In October 2025, China filed a similar complaint against India’s PLI schemes for Electric Vehicles and batteries. Tensions flared further late in the year when India imposed anti-dumping duties on Chinese cold-rolled steel to shield domestic steelmakers. The December filing targets the heart of India's tech ambitions: the tariffs that forced companies like Apple to manufacture locally, and the subsidies nurturing a domestic solar industry to reduce reliance on Chinese panels.

While headlines scream "Trade War," the deeper story is the "Green Protectionism Paradox." China is using the WTO—an institution built for free trade—to attack India’s Green Industrial Policy. The irony is palpable: China built its own global dominance in solar and EVs using the exact same playbook of subsidies and state support it now calls "illegal" when India uses it. This isn't just a legal dispute; it is a "Ladder-Kicking" Strategy, where the dominant player tries to use international rules to prevent emerging rivals from climbing the same ladder of state-led development.

Furthermore, the attack on ICT tariffs is an attempt to smash India’s "Tech Wall." India’s high tariffs on imported electronics successfully coerced global giants to set up factories in India. If China wins this case, it could force India to slash these tariffs, potentially reversing the "Make in India" smartphone success story and flooding the market once again with fully assembled Chinese tech.

If the WTO rules against India, New Delhi faces a difficult choice: comply and dismantle the PLI architecture that underpins its manufacturing boom, or ignore the ruling and face retaliatory sanctions. This dispute puts the entire "China Plus One" strategy on trial. For Indian manufacturers in Gujarat (solar) and Tamil Nadu (electronics), the outcome will determine whether they continue to receive state protection or face a renewed onslaught of cheap Chinese imports.

If every major economy is now using subsidies to fight climate change and secure supply chains, is the WTO’s rulebook protecting fair trade, or just protecting the monopolies of early movers?

Why did China file a WTO complaint against India in December 2025?

China requested dispute consultations with India at the WTO to challenge New Delhi's tariffs on Information and Communication Technology (ICT) products and subsidies provided to the solar power sector. Beijing alleges these measures discriminate against imported Chinese goods and violate global trade norms regarding national treatment.

What are the two major WTO disputes between China and India in 2025?

In late 2025, China initiated two distinct disputes:

Did India ban Chinese steel imports in 2025?

India did not implement an outright ban but imposed anti-dumping duties on certain Chinese steel products, specifically cold-rolled steel, in late 2025. This was done to protect domestic steel manufacturers from being undercut by cheap imports, adding to the trade friction that led to the WTO complaints.

News Coverage

Analysis & Context

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs